It permits sales professionals to pinpoint successful strategies and techniques, as properly as those who may require refinement. Moreover, it serves as a motivational device, encouraging salespeople to consistently meet and exceed their targets. Digital sales journal options have revolutionized credit sales monitoring. Trendy accounting software program automates many conventional handbook processes, lowering errors and increasing effectivity. These technological advances make it simpler to take care of accurate records and generate insightful stories.

This sort of journal entry is often used by companies that promote merchandise on consignment or offer to finance to prospects. However, in actuality, many should still use the sales daybook to record money sales. The objective of a gross sales journal entry is to trace the company’s gross sales and income.

- A column for the transaction date, account name or customer name, bill number, posting check field, accounts receivable amount, and price of goods bought quantity.

- The remedy of those gross sales discounts impacts the ultimate calculation of net gross sales, because it involves subtracting the entire reductions from gross sales to reach at the net gross sales determine.

- Observe there’s a single column for each the debit to Accounts Receivable and the credit to Gross Sales, though we need to submit to both Accounts Receivable and Sales at the end of every month.

- While all firms maintain a single journal for bookkeeping data, some companies prefer to divide journals into a number of types which makes it simple to track down financial information.

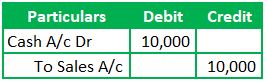

Credit Gross Sales Journal Entry

You don’t need to track collections or accounts receivable, and there is no danger of default. We cover the principle kinds of sales journal entries, the way to report them step-by-step, and particular concerns for various business conditions. On the other hand, basic journal entries are more versatile and might embody a broad range https://www.simple-accounting.org/ of transactions, together with adjusting entries, accruals, and depreciation. They serve as a central hub for recording miscellaneous monetary transactions that don’t fall under the particular classes lined by specialized journals.

It’s the quiet coach that is at all times there, guiding, encouraging, and pushing gross sales professionals in the direction of their greatest selves. From the perspective of a gross sales manager, the alignment means setting clear, quantifiable targets which may be instantly entered into the sales journal. For instance, if the objective is to increase sales by 20% within the subsequent quarter, the journal ought to mirror this by way of entries that observe progress against this target. It Is not just about recording sales as they happen; it’s about actively looking for out and documenting alternatives that will help meet or exceed the set objectives. Be Taught how to record transactions precisely and keep correct documentation.

In right now’s globalized and digitalized world, language is a vital issue for effective… I was nominated as one of the promising entrepreneurs by a enterprise journal a very long time again. I worked in Telco way again in 1993 and then started my leather-based enterprise. Shaun Conrad is a Licensed Public Accountant and CPA examination skilled with a passion for instructing. After virtually a decade of expertise in public accounting, he created MyAccountingCourse.com to assist individuals study accounting & finance, move the CPA exam, and begin their profession.

To investigate these posted balances within the basic ledger, one can refer again to the gross sales journal and use the listed bill number to locate a replica of the bill. Additionally, an adjusting journal entry may be made to ensure that income and expenses are recognized within the appropriate interval. The Accounts Receivable control account in the basic ledger is the entire of all of the quantities prospects owed the company. Also at the finish of the month, the entire debit in the price of goods offered column and the entire credit score to the merchandise stock column would be posted to their respective basic ledger accounts. The sales journal functions as a crucial component throughout the broader accounting ecosystem. Its integration with other accounting records ensures accurate monetary reporting and maintains the integrity of your business’s monetary data.

Gross Sales Returns And Allowances

For occasion, a time-series analysis may reveal that sales peak during certain months, allowing for inventory adjustments in anticipation of elevated demand. Each sale ought to set off a reduction in stock portions and values to keep your inventory records and financial reporting accurate. This includes money funds, checks, credit and debit card funds, and quick electronic transfers. Gross Sales journal entries allow you to track the money coming into your small business. These records capture key particulars about every sale, making it easier to remain compliant with regulations and maintain a clear report of your financial activities.

This whole will then be posted to the general ledger, rising the Accounts Receivable account by $1,310 and in addition growing the Sales Income account by the same amount. From the attitude of a financial analyst, gross sales forecasting is about numbers and developments. They rely on quantitative strategies, similar to time-series evaluation, regression fashions, and machine studying algorithms, to foretell future gross sales.

From the perspective of a new gross sales recruit, the journal is a repository of non-public progress, documenting the evolution from novice to expert. It holds the document of every name made, every deal closed, and each lesson learned. For a seasoned gross sales veteran, it’s a strategic asset, helping to refine tactics and maintain a profitable streak. The journal acts as a mirror, reflecting the strengths to be leveraged and weaknesses to be addressed. By analyzing their gross sales journal, they discover a consistent increase in sales after launching focused email campaigns. This perception allows them to forecast larger gross sales in quarters where such campaigns are deliberate.

Accounting Ratios

These reductions are recorded within the gross sales discount journal, lowering the whole accounts receivable. Whereas a journal entry of gross sales helps organize credit gross sales, guide entries can result in mistakes that affect monetary accuracy. It’s not just a tool for recording numbers, it’s the backbone of monitoring credit gross sales and ensuring your business’ financials runs easily. We enter all money acquired into the cash receipts journal, and we enter all money payments into the cash disbursements journal, generally also recognized as the cash payments journal. Good internal management dictates the most effective rule is that each one cash acquired by a enterprise ought to be deposited, and all money paid out for monies owed by the business should be made by examine. Money paid out is recorded in the money disbursements journal, which is generally kept in numerical order by examine number and includes all the checks recorded within the checkbook register.

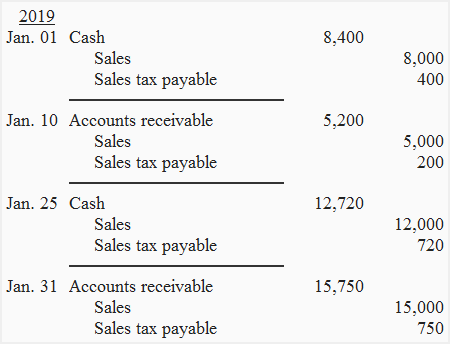

Including the shopper name within the sales journal facilitates the linkage between the sales entry and the corresponding ledger entries. For occasion, when a customer makes a purchase on credit, the gross sales journal entry will present the sale, while the accounts receivable and common ledger entries will reflect the amount owed by the client. When goods are bought on credit score, businesses need to record a sales journal entry to correctly replicate the revenue that has been earned. The sales credit journal entry should include the date of the sale, the shopper’s name, the amount of the sale and the Accounts Receivable amount. Once the client pays their invoice, the enterprise will then need to record a separate cost journal entry.